Explore Offshore Trust Services: Safeguarding Your Financial Tradition

Wiki Article

Setting Out for Financial Liberty: Checking Out Offshore Trust Solutions as a Gateway to International Riches Management

Are you prepared to start a trip in the direction of financial flexibility? Look no more than overseas trust solutions as your portal to global riches monitoring. In this short article, we will certainly direct you via the ins and outs of understanding overseas trust services, the advantages they provide in regards to asset security, just how to choose the ideal offshore jurisdiction, and crucial factors to consider for constructing your own depend on. Prepare yourself to maximize your returns and set out for a flourishing future.

Comprehending Offshore Count On Services: A Trick to International Riches Management

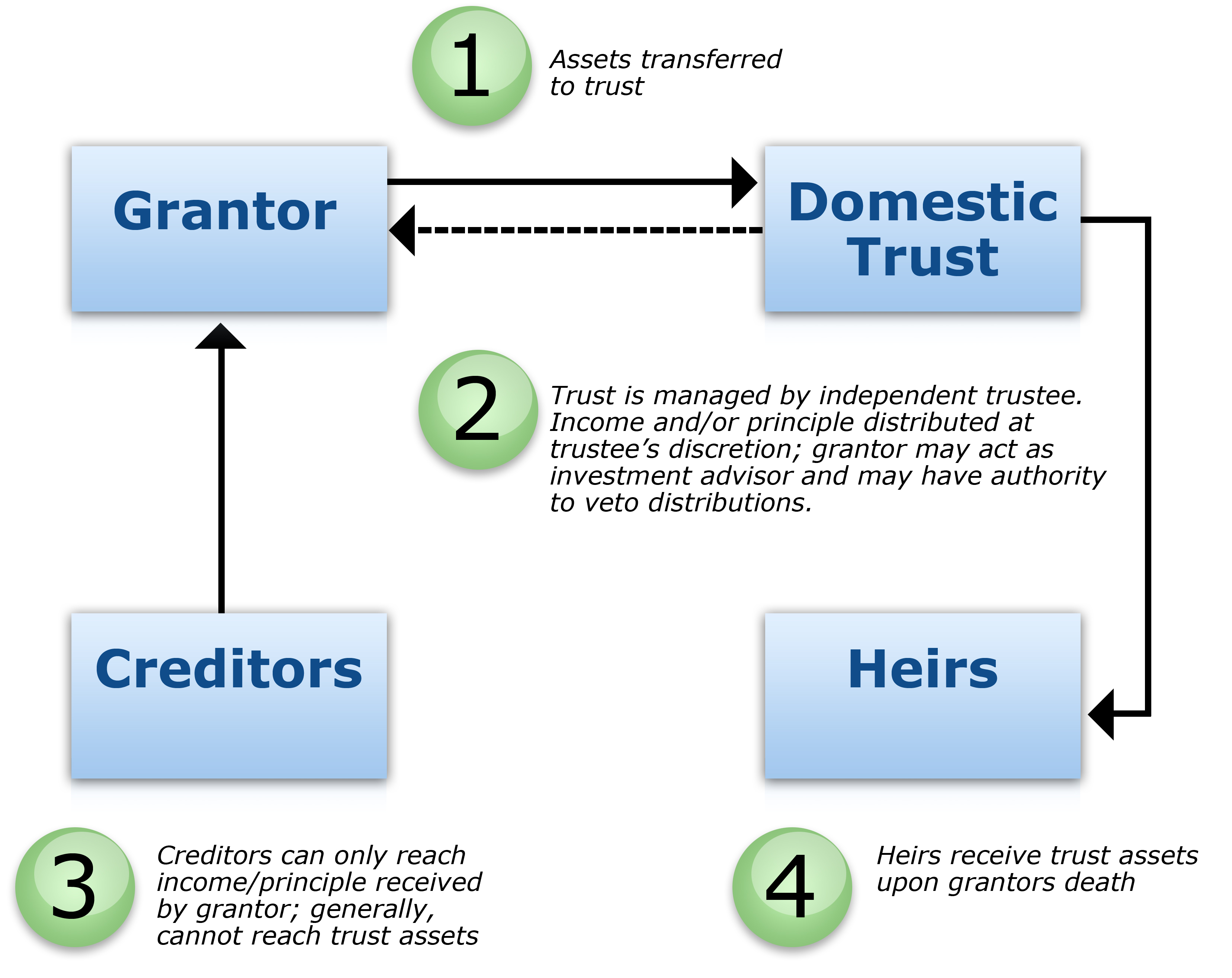

Understanding overseas count on services is vital for those seeking to take part in international riches management - offshore trust services. Offshore trust funds are a powerful tool that permits individuals to safeguard and expand their possessions in a private and tax-efficient manner. By positioning your possessions in an offshore trust fund, you can gain from lawful and economic advantages that are not readily available in your home nationOne of the major advantages of overseas depend on services is the capacity to reduce tax obligation obligations. Offshore territories commonly have much more favorable tax laws, enabling you to legitimately decrease your tax obligation burden. This can lead to significant cost savings and raised riches buildup in time.

An additional advantage of offshore depends on is the level of asset defense they provide. By putting your properties in a territory with strong possession defense laws, you can guard your wealth from prospective financial institutions, lawsuits, or other monetary threats. This can offer you peace of mind recognizing that your hard-earned money is secure.

In addition, overseas trust services provide a high degree of personal privacy and discretion. Offshore jurisdictions focus on customer discretion, ensuring that your financial affairs stay personal. This can be especially valuable for individuals who value their personal privacy or have problems about the safety of their assets.

Benefits of Offshore Trust Services in International Asset Protection

Maximize your asset protection with the advantages of offshore trust solutions in protecting your worldwide wealth. Unlike typical onshore trust funds, offshore depends on provide a greater level of personal privacy, making sure that your monetary events remain discreet and shielded from prying eyes. offshore trust services.An additional considerable advantage of overseas depend on services is the versatility they supply in terms of wide range management. With an overseas count on, you have the capacity to diversify your properties across various jurisdictions, enabling you to make the most of positive tax obligation programs and financial investment opportunities. This can cause considerable tax obligation savings and boosted returns on your financial investments.

Additionally, overseas trust services give a higher level of property protection compared to residential trusts. In case of a lawful disagreement or financial dilemma, your overseas trust fund can serve as a guard, guarding your assets from prospective lenders. This included layer of defense can provide you with comfort and make sure the long life of your riches.

Exploring Offshore Jurisdictions: Choosing the Right Area for Your Trust Fund

When choosing the best offshore territory for your trust fund, it's important to think about aspects such as tax obligation benefits and lawful structure. Offshore territories supply an array of advantages that can help protect your properties and maximize your economic monitoring. By carefully considering these factors, you can choose the right offshore jurisdiction for your trust fund and get started on a trip in the direction of monetary flexibility and worldwide riches management.Structure Your Offshore Depend On: Secret Considerations and Strategies

Choosing the appropriate jurisdiction is essential when building your overseas depend on, as it identifies the degree of legal security and stability for your properties. Building an overseas depend on requires mindful consideration and strategic preparation. You require to determine your objectives and goals for the trust fund. Are you seeking to safeguard your properties from potential legal actions or lenders? Or probably you want to decrease your tax responsibilities? It is vital to research and review different territories that align with your needs when you have actually defined your goals. Seek jurisdictions with strong lawful structures, political stability, and a positive tax obligation environment. Furthermore, consider the track record and record of the jurisdiction in dealing with overseas trust funds. Consult from specialists that specialize in offshore depend on solutions, such as lawyers or wealth managers, who can lead you through the process and help you navigate the complexities of offshore jurisdictions. Each territory has its very own collection of laws and regulations, useful reference so it is essential to understand the economic and lawful ramifications before making a decision. By taking the time to thoroughly select the best jurisdiction, you can ensure that your offshore trust fund gives the degree of defense and security you prefer for your assets.Making The Most Of Returns: Spending Methods for Offshore Trusts

Spending in a diverse profile can aid offshore depends on achieve greater returns. One of the most important facets to think about is just how to maximize your returns when it comes to managing your overseas trust. By expanding your investments, you can reduce threat and increase the capacity for better gainsFirst and foremost, it's crucial to recognize the concept of diversity. This approach involves spreading your investments throughout different property classes, markets, and geographical areas. By doing so, you are not placing all your eggs in one basket, which can assist secure your profile from possible losses.

When selecting investments for your offshore depend on, it's necessary to think about a mix of assets, such as supplies, bonds, property, and assets. Each property class has its own risk and return qualities, so by purchasing a range of them, you can possibly take advantage of various market problems.

In addition, remaining notified concerning market fads and economic signs is vital. By remaining updated with the most recent information and occasions, you can make enlightened financial investment choices and readjust your profile as necessary.

Verdict

So currently you recognize the advantages of overseas depend on services as a gateway to international wealth management. By understanding the key factors to consider and methods associated with developing your offshore trust, you can optimize your returns and secure your possessions. Selecting the right offshore territory is critical, and with the look these up ideal investment techniques, you can set out in the direction of monetary liberty. Embrace the possibilities that offshore depend on services begin and offer on a trip towards global wide range monitoring.In this post, we will assist you through the ins and outs of comprehending offshore depend on services, my company the advantages they provide in terms of property protection, exactly how to choose the ideal overseas jurisdiction, and vital considerations for constructing your own depend on. Unlike typical onshore trust funds, offshore trusts use a greater degree of privacy, making certain that your economic affairs continue to be very discreet and safeguarded from prying eyes.

In addition, overseas depend on solutions provide a higher degree of possession protection contrasted to residential trusts.Picking the right jurisdiction is critical when building your offshore trust, as it determines the degree of lawful security and stability for your assets. Seek guidance from specialists who specialize in overseas depend on services, such as lawyers or wide range managers, who can guide you via the process and aid you browse the complexities of offshore jurisdictions.

Report this wiki page